Search This Blog

Appliedeconomist.net

Posts

Featured

Latest Posts

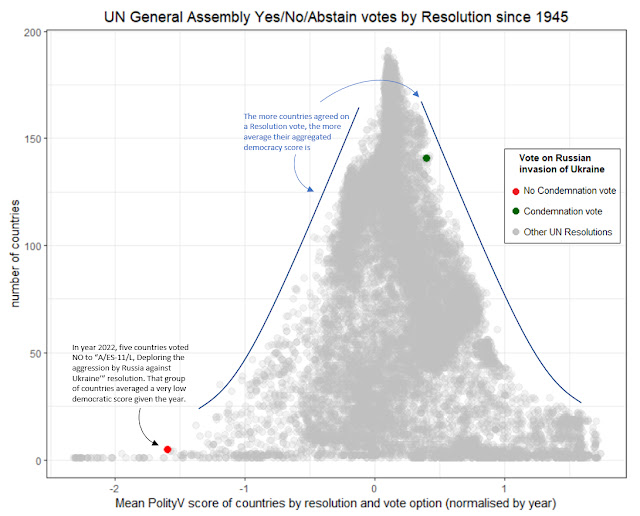

Assessing 16,000 UN General Assembly resolutions

- Get link

- Other Apps

Information impact on Market Performance

- Get link

- Other Apps

NBER Paper: Folklore by Stelios Michalopoulos and Melanie Meng Xue

- Get link

- Other Apps

Air Filters, Pollution, and Student Achievement

- Get link

- Other Apps

.jpg)